Images

Gold (Futures price, August 2012 basis) last 3 months

The trend is bumpy, down the staircase, not quite up

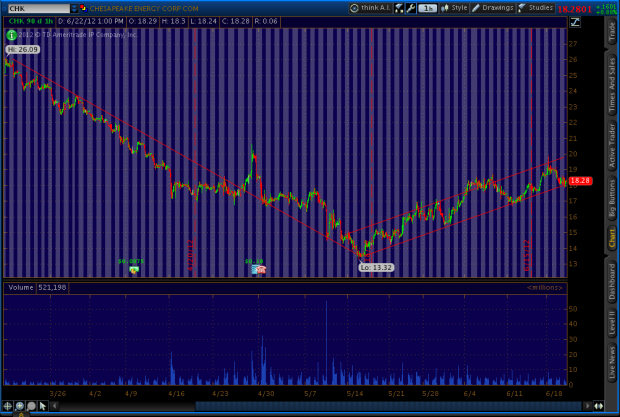

A chart of $CHK

A chart of Chesapeake Energy $CHK loved for assets and reviled by some for its chief asset accumulator, Aubrey McClendon

King Dollar continues its reign or will be deposed by a bullish risk-on bounce?

$DX_F Dollar index as a refuge for safety, risk-off, but if risk may be increasing, lower highs may continue

Nasdaq bumpy bounces make for fake break(outs).

NQ_F Nasdaq futures as just one equity index stumbling for direction.

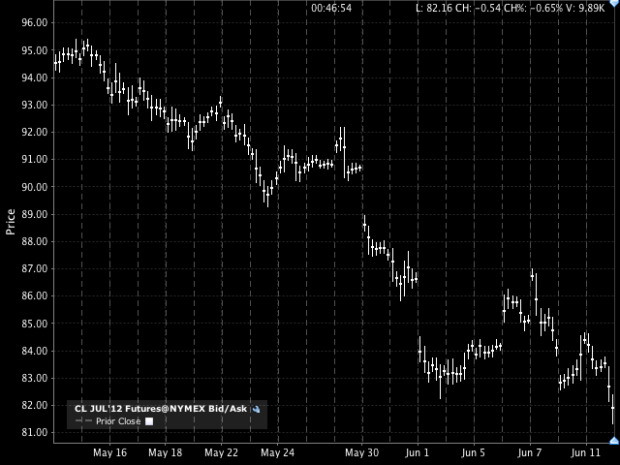

West Texas Intermediate (WTI) Crude prices keep dripping down

Crude futures, July 2012 basis

Soybean meals feed a massive bounce. Will the breakout continue?

Soybean Meal, August 2012 basis

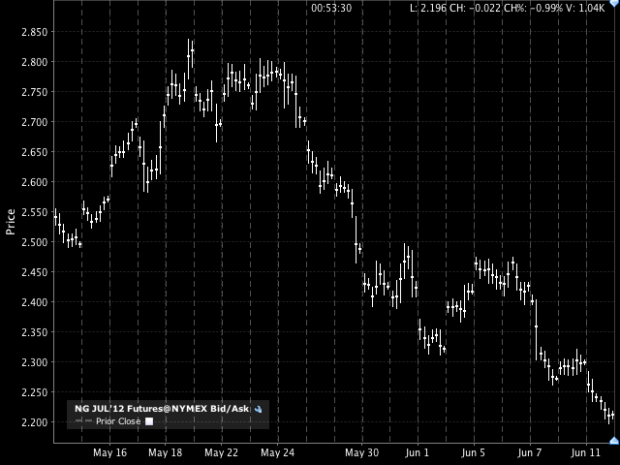

Natural Gas futures, July 2012 basis

Natural gas keeps dropping

3 Year Australian Treasury Bond

Will the trend continue? A way to play China, without shorting Australia as a proxy.